Most companies conduct a digital marketing competitor analysis before they start planning and strategizing.

Digital marketing competitor analyses help you understand your competitors, their best marketing efforts, and their mistakes (that you can avoid).

In this article, we’ll explore the why and how of digital marketing competitor analyses and look at how to improve your own digital marketing strategy using the Semrush Traffic & Market digital analytics tools. Let’s get started!

What Is Digital Marketing Competitor Analysis?

Conducting a competitor analysis is the process of researching your market to identify competitors, unpack the characteristics of competitors’ businesses, and analyze their strategies.

A competitor analysis is typically carried out to identify the strengths and weaknesses of other market players, define your company’s standing in relation to them, and highlight gaps and estimate your potential to fill them.

Competitor analysis in the digital marketing context has some unique characteristics because of the fast-changing nature of the online landscape.

Digital markets evolve rapidly and technology allows businesses operating in the digital landscape to pivot in an instant. That said, unlike traditional marketing channels, digital platforms offer an abundance of data and metrics that can be harnessed to gain insights into competitors' strategies.

Who Should You Analyze as Competitors in Digital Marketing?

Once you decide competitor analysis is necessary for your online marketing plan, you need to figure out who your competitors in digital marketing actually are.

If you’ve been running your business online for a while, a few digital competitors may come to mind right away. But it’s important not to rely just on your experience and intuition. You may be surprised by who you’re actually competing with in terms of traffic acquisition.

Direct Competitors, Indirect Competitors, & Brand Competitors

Competitor analysis normally includes a close look at both direct competitors and indirect competitors. Then, there are brand competitors. We’ll look at how to pinpoint competitors later, but for now, let’s define our terms:

- Direct Competitors—Businesses that offer similar products or services and target the same customer segment, competing directly with each other for market share.

- Indirect Competitors—Businesses that offer different products or services, but target the same or similar customer segment, potentially fulfilling similar needs or providing substitute solutions.

- Brand Competitors—Brand competitors are much like direct competitors. The difference is brand competitors have established strong brand identities and customer loyalty, setting themselves apart through reputation and unique value propositions.

When it comes to digital marketing, traffic is the name of the game. Whether you’re analyzing advertisements on social media, organic traffic from Google, or referrals from other domains, your competitors are those websites that are drawing traffic away from your site to their own.

How Are Digital Marketing Competitors Different from Other Kinds of Competitors?

Digital competitors in online marketing compete for the same audience through digital channels and strategies like social media, SEO, PPC, email, and content marketing.

On the other hand, non-digital competitors are focused on traditional channels like TV, print media, radio, billboards, and physical stores to reach their audience.

The key difference lies in the channels they use:

- Digital Competitors: Utilize online platforms like websites, social media, mobile apps, and email marketing.

- Non-digital Competitors: Focus on offline channels such as TV, radio, print, direct mail, and physical storefronts.

Remember, some businesses may be competitors only in the digital realm, without affecting your offline presence.

Why Is Ongoing Competition Tracking Important?

While your main competitors are not likely to change that much over time, their positions and the general market conditions will shift constantly.

Here are the key reasons to check up on other market players on a regular basis:

- To review benchmarks—From monitoring your internal stats, you know which channels perform best. But what if your competitors have managed to achieve even better results? You need to know what they’re doing to stay on the cutting edge with your strategy.

- To catch up with industry and market trends—There are some seasonal trends that reoccur every year, and there are peaks and declines in demand that you will be prepared for only if you monitor the competitive landscape. Make sure to stay alert.

- To learn the best new practices and the mistakes to avoid—Experimentation is key in marketing, but you can only do so much with the budget you have. Sometimes it’s a good idea to let your competitors test new channels rather than go there yourself and waste your budget. Learn from other companies' experience.

- To stay on top of competitor activity—From digital marketing campaigns you can get some important news on your competition, such as a new product launch, and get ideas for your own company’s development.

- To refine your goals—As the situation in the online market changes, you may need to adjust not just your strategy, but also the objectives you previously set.

Digital Analytics: Deciding What Competitor Activity to Analyze

Digital analytics provides you with a wealth of information about your competitor’s online presence, customer behavior, and campaign performance. However, with so much data available, it's crucial to know what to measure and why. In this section, we’ll explore key metrics and measurements that are essential for effective digital analytics.

What to Measure:

- Competitive Landscape Dynamics—Monitoring competitor roles in the marketplace and how their traffic has grown or declined over time can help you pinpoint players to watch and study.

- Website Traffic—Monitoring the number of visitors to a competitor’s website is fundamental. It helps you understand the reach and popularity of their presence, and provides insights into user behavior.

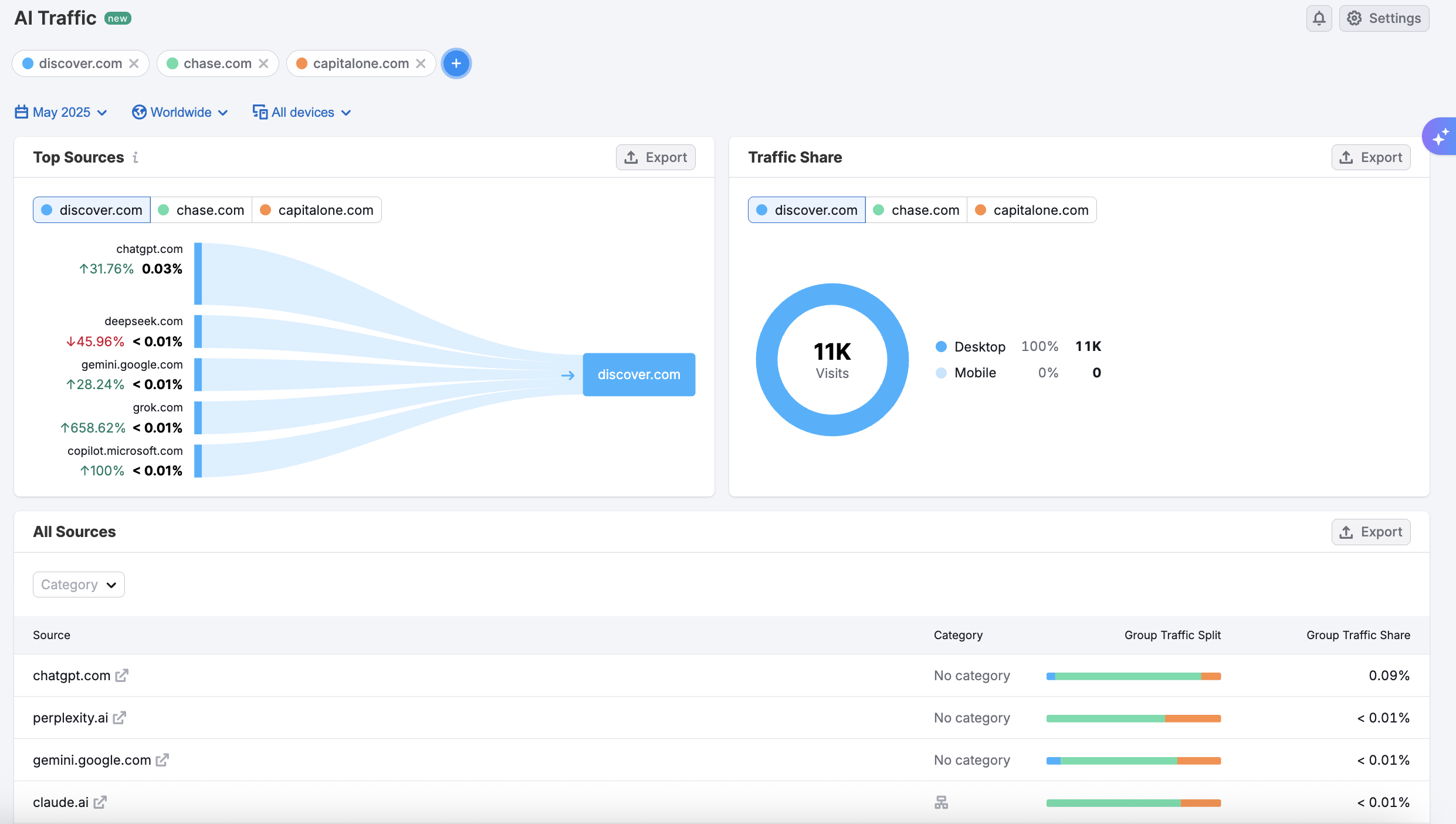

- AI Traffic — Measuring traffic from AI-powered sources helps you track shifts in how users discover content, so you can adapt your strategy to stay competitive in a changing digital landscape.

- Traffic Channel Breakdowns—Measuring traffic channel breakdowns allows you to gain valuable insights into the performance of different acquisition channels and make data-driven decisions to enhance your digital marketing strategies.

- Engagement Metrics—Measuring metrics like bounce rate, time on site, and page views per session provides insights into how users interact with your competitors’ website. It helps identify areas for improvement and optimize user experience.

- Social Media Metrics—Monitoring social media engagement, follower growth, likes, shares, and comments helps assess the impact of your social media presence and content strategy.

- Email Campaign Metrics—Tracking email open rates, click-through rates, and unsubscribe rates helps evaluate the effectiveness of your email marketing efforts and refine your email campaigns.

- Conversion Rates—Tracking conversions, such as purchases, sign-ups, or form submissions, allows you to gauge the effectiveness of your competitors’ marketing strategies in driving desired actions.

By understanding what to measure and why, you can unlock the power of data and leverage digital analytics to drive strategic decisions, improve performance, and achieve their marketing goals.

How to Do Competitor Analysis in Digital Market Using Semrush

The Semrush Traffic & Market Toolkit provides the unique ability to analyze your market landscape, your competitors traffic, their marketing strategy, their online activity, and their growth dynamics.

In this section, we’ll use Traffic & Market to do a quick digital marketing analysis of the credit card industry in just five steps.

1. Explore Competitor Target Audiences for Insights

As a starting point, get to know your competitors' audiences. This will provide a foundation for your marketing strategy. Not only will it help you determine how your audience differs from your top competitors, it can reveal new valuable audiences you may want to target later.

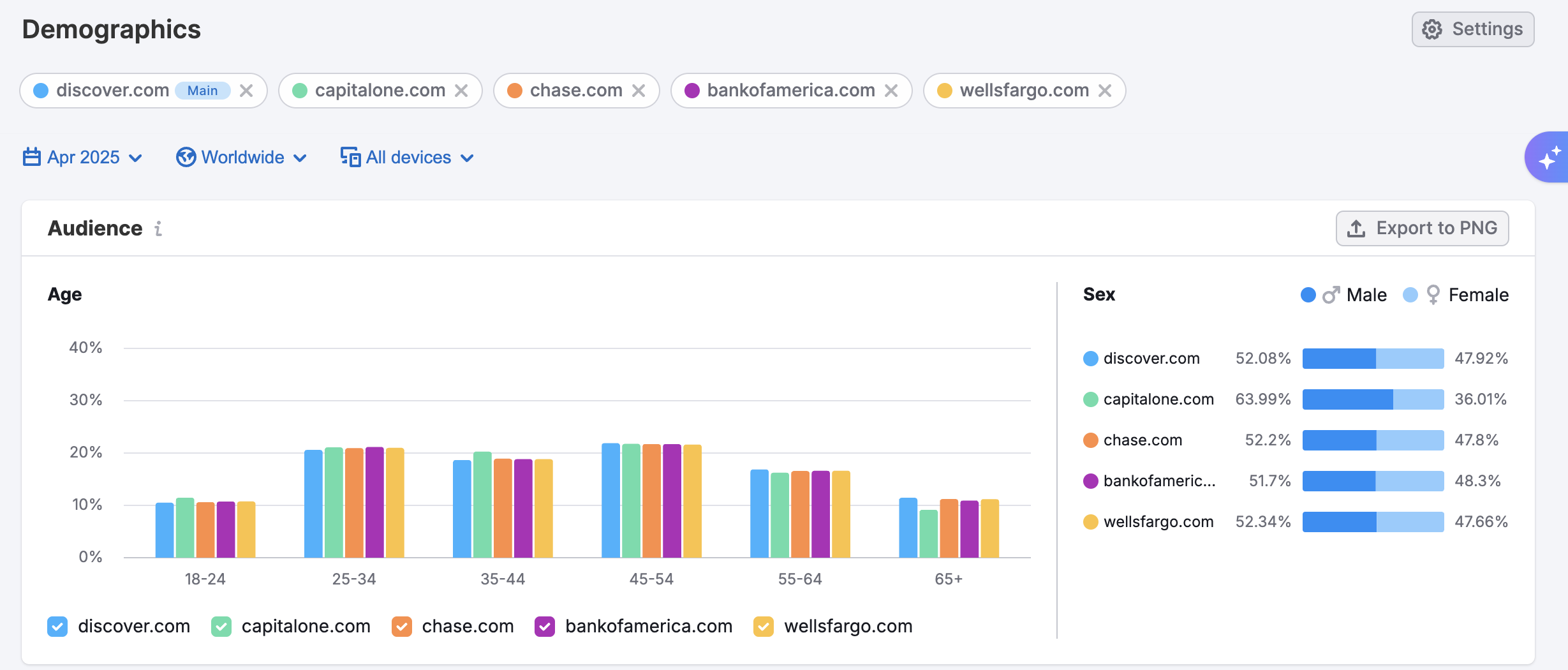

The Demographics dashboard makes it easy to understand the demographic breakdowns of your competitors’ audiences. Here’s a look at the Demographics dashboard for the 5 top credit card companies in our market.

Overall, we can see that the majority of audience members for our domains are men in the 25-34 age range, and the 45-54 age range.

Looking at the individual players, however, we notice some distinctions. For example, it looks like capitalone.com skews slightly younger with higher than average numbers in the 18-24 range and lower than average numbers of audience members over 55.

Knowing this can help us think about how we want to position our business and which audiences we want to approach.

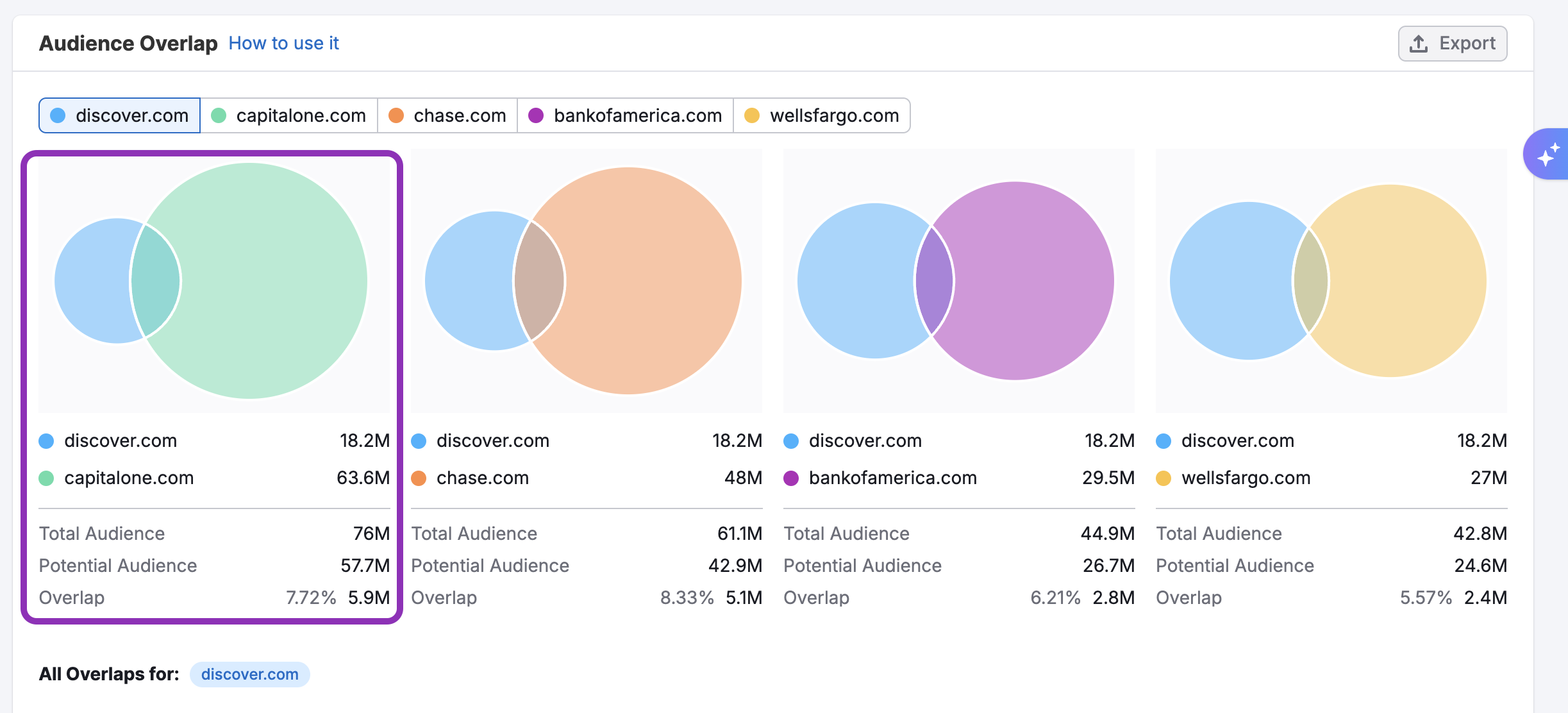

The Audience Overlap dashboard can also provide insights. For example, we can see discover.com has the largest audience overlap with capitalone.com.

The potential audience Discover could gain by targeting Chase’s audience is a massive 57.7M people. And using the Visited domains section below the ven diagrams, we can find out where Chase’s audience spends their time online to inform our ad and partnership strategies.

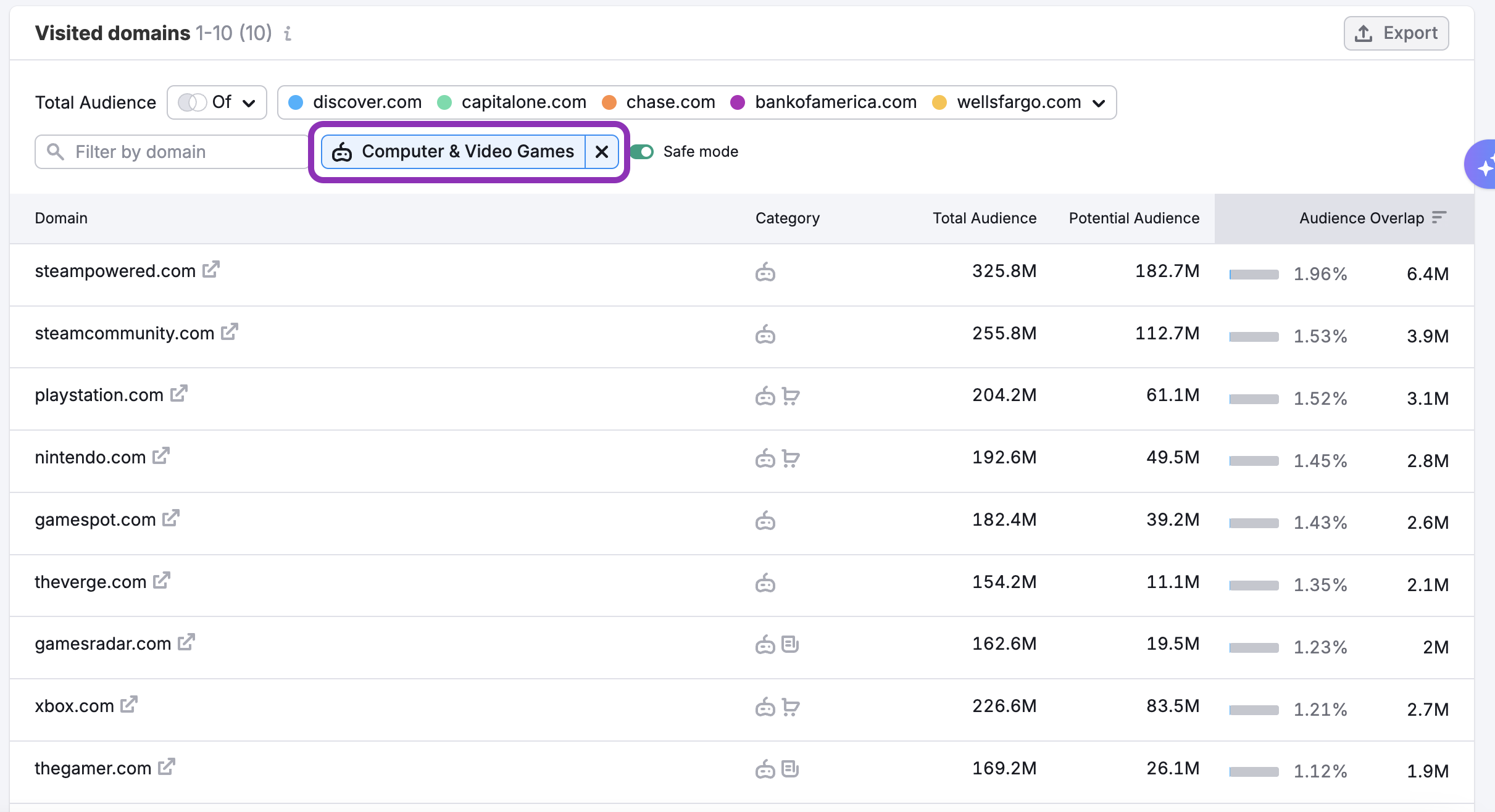

For example, if we wanted to target a younger demographic, we filtered the list by the Computer & Video game category and here’s what we uncovered.

Looking at domains that chase.com’s audience overlaps with in the computer and video game category, we discovered a few potential targets for ads and partnerships.

2. Analyze Competitor Activity Across the Market Landscape

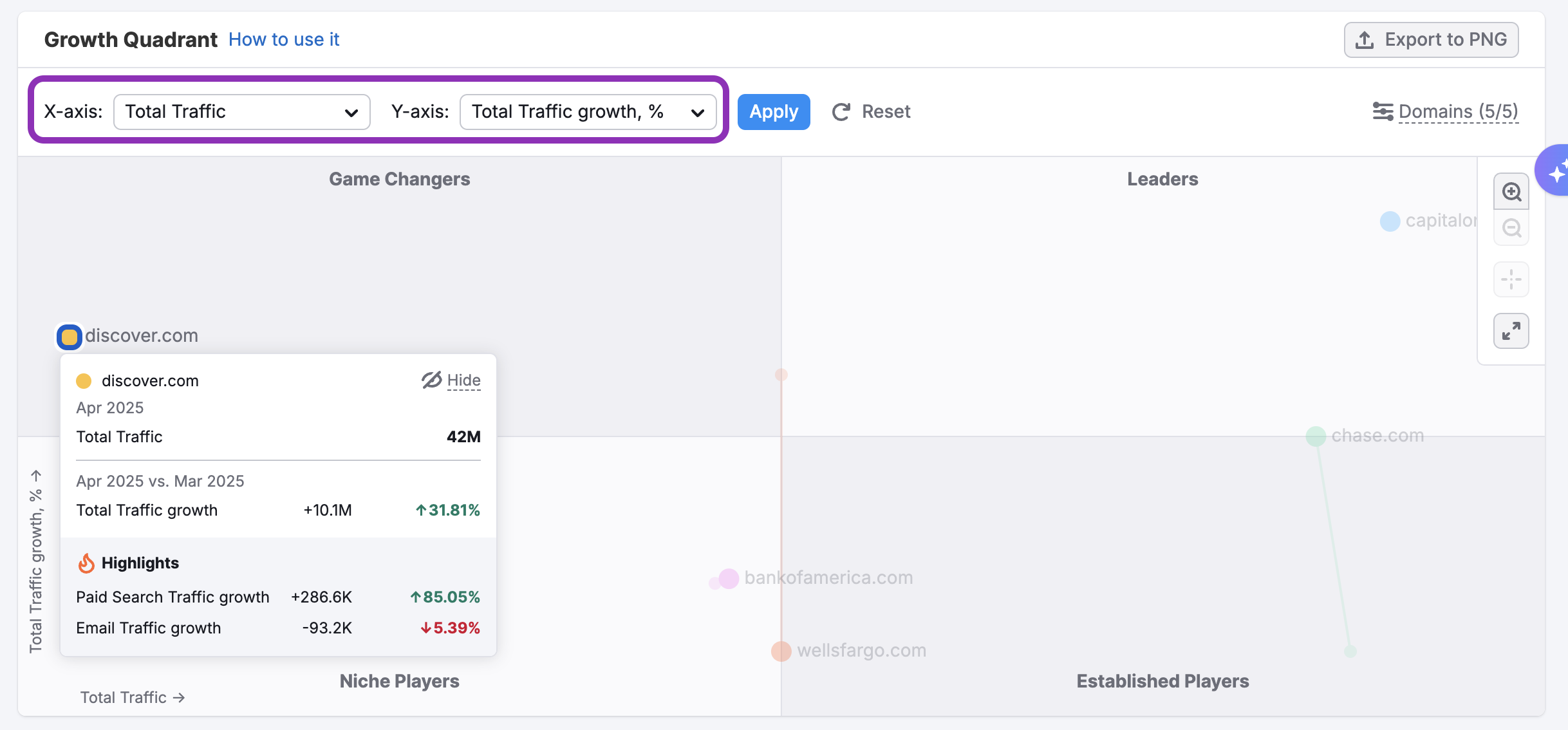

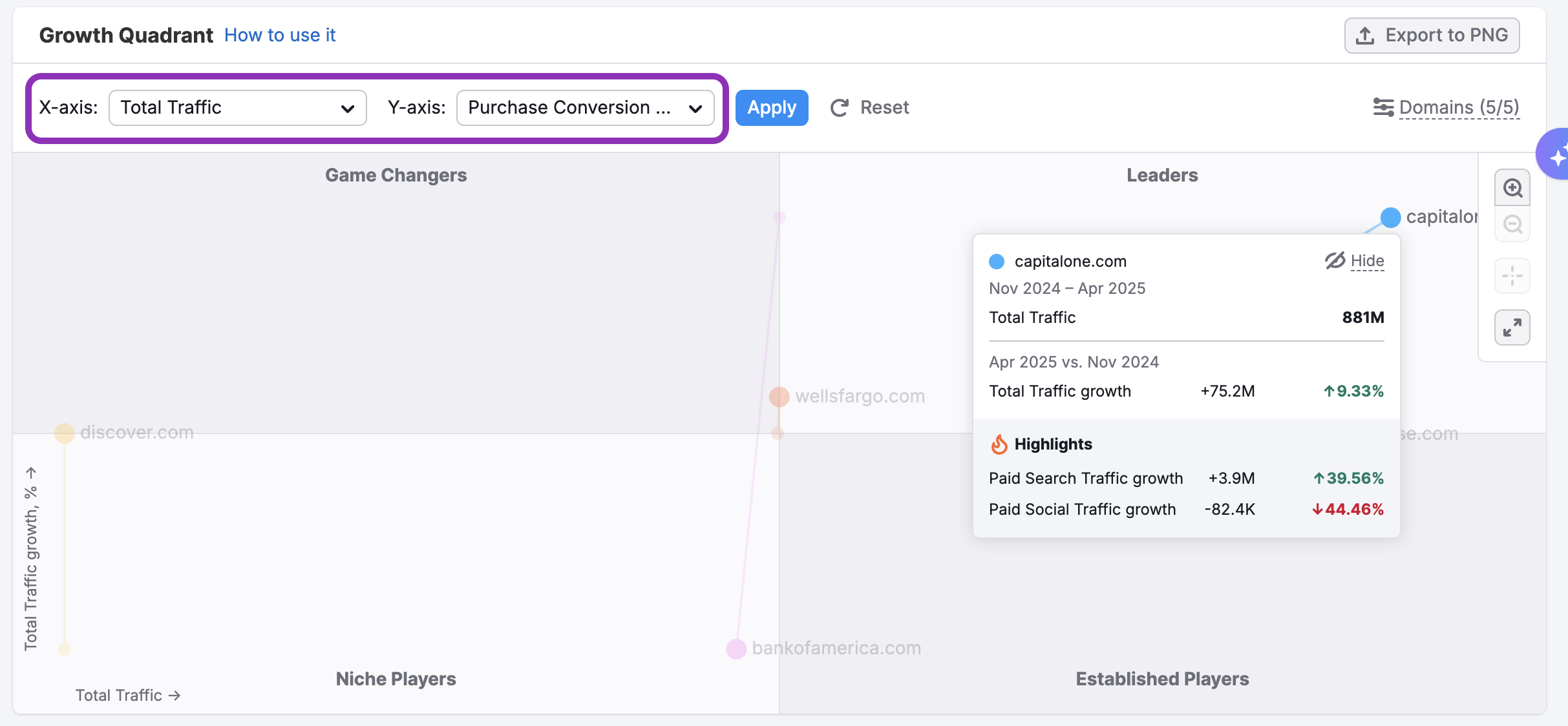

Using the Market Overview dashboard, let’s get an overview of the competitive landscape and see which players are making the biggest gains. The Growth Quadrant is your go to for competitive landscape analysis.

Here’s a look at traffic growth for top players in the industry.

Here, we see discover.com has seen a 32% growth in traffic over the past year, pushing them into the Game Changers category.

You can also select different metrics to define your X and Y-axis to see how different competitors have experienced growth or declines along various criteria. For example, we selected Traffic for our X-axis and Purchase Conversions for our Y-axis.

Here, we found a different competitive layout. By identifying what competitors are showing the best results for different kinds of metrics, you can figure out who to watch and where to look for insights to apply to your own strategy.

3. Unpack Competitor Traffic Acquisition Strategies

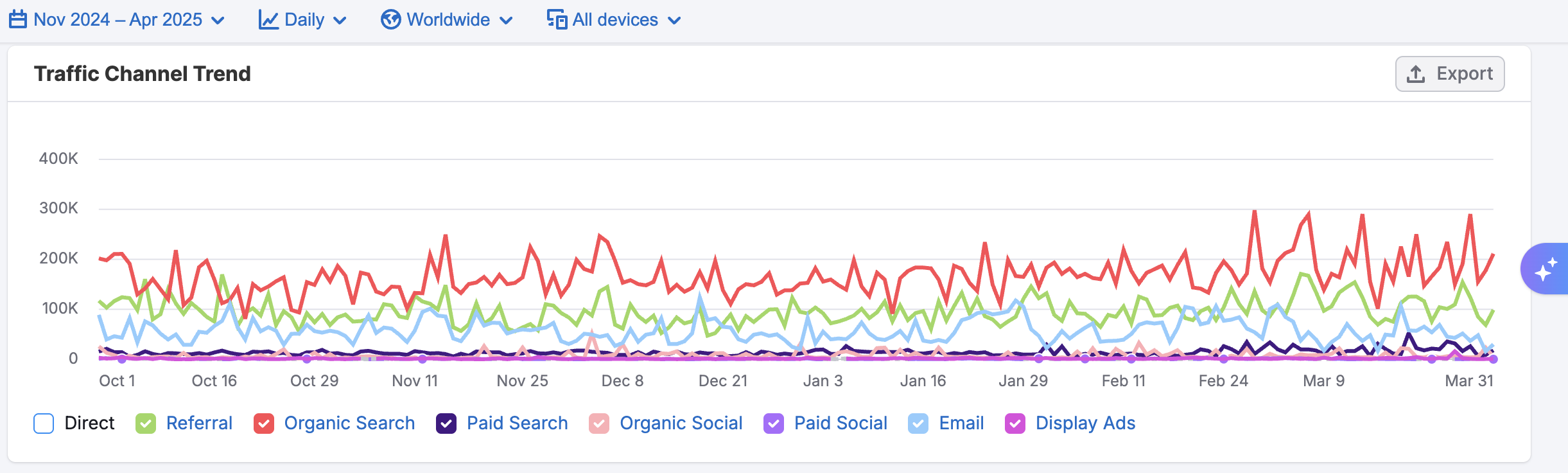

We identified americanexpress.com as one of the fastest growing domains in our market. Let’s turn to the Traffic Overview dashboard to better understand their traffic acquisition strategy.

The Traffic Channel by trend widget is a great place to start examining competitor traffic. It allows you to choose a specific traffic channel, view the traffic trend over time, and track growth month by month.

Once we discover the channels where they’re seeing growth, we can dig deeper with the dashboards for each traffic channel. For example, we see strong a Organic Search trend in the graph above– here’s a look at the breakdown using the Organic Search dashboard.

Here, we can see top and trending pages in the channel, top sources, and top keywords which can help us better understand how they’re driving traffic.

We can also explore the AI Traffic dashboard to see how much of their traffic is coming from AI-powered sources, such as search assistants or chatbot recommendations. This helps us understand whether they're gaining visibility through emerging channels—and how we might adjust our own strategy to stay competitive as discovery patterns evolve.

By analyzing each traffic channel—including emerging sources like AI—we gain a clear, data-backed view of how top competitors are acquiring traffic and where new growth opportunities may lie.

4. Review Competitor Activity Related to Campaigns and Promos

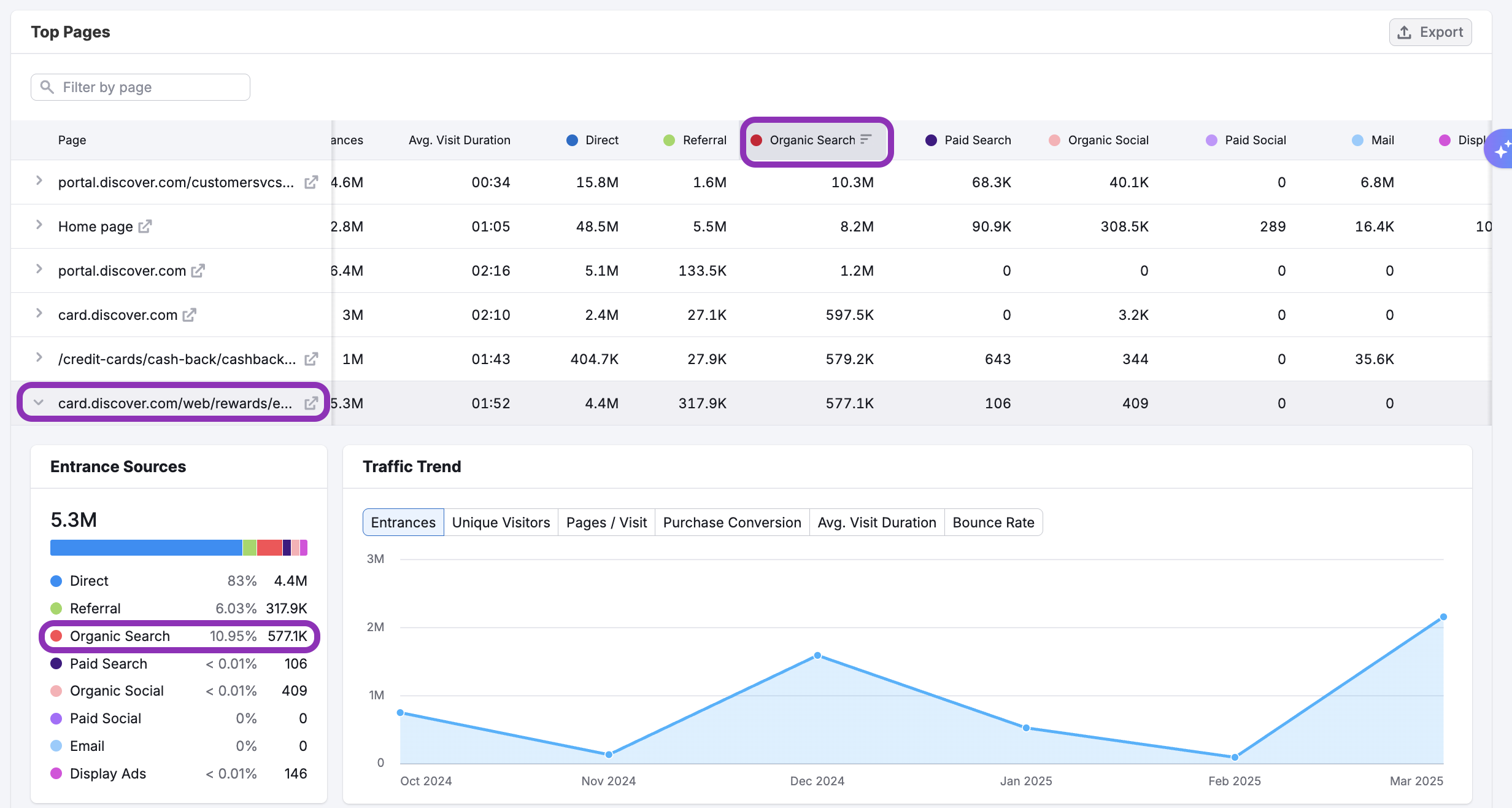

Now that we know the Organic Search channel is key for discover.com’s strategy, let’s turn to the Top Pages dashboard to take a look at what products they’re promoting through this channel.

We organized the table by the Organic Search channel to bring the highest performing pages to the top of the list.

By focusing on the top-performing pages from Organic Search, we can quickly identify which campaigns and product promos are driving the most visibility for discover.com. This helps uncover not just what’s being prioritized, but how effectively those efforts are capturing user interest—giving you a clearer path to refine your own promotional strategy.

5. Set Up Ongoing Competition Tracking to Stay in the Loop

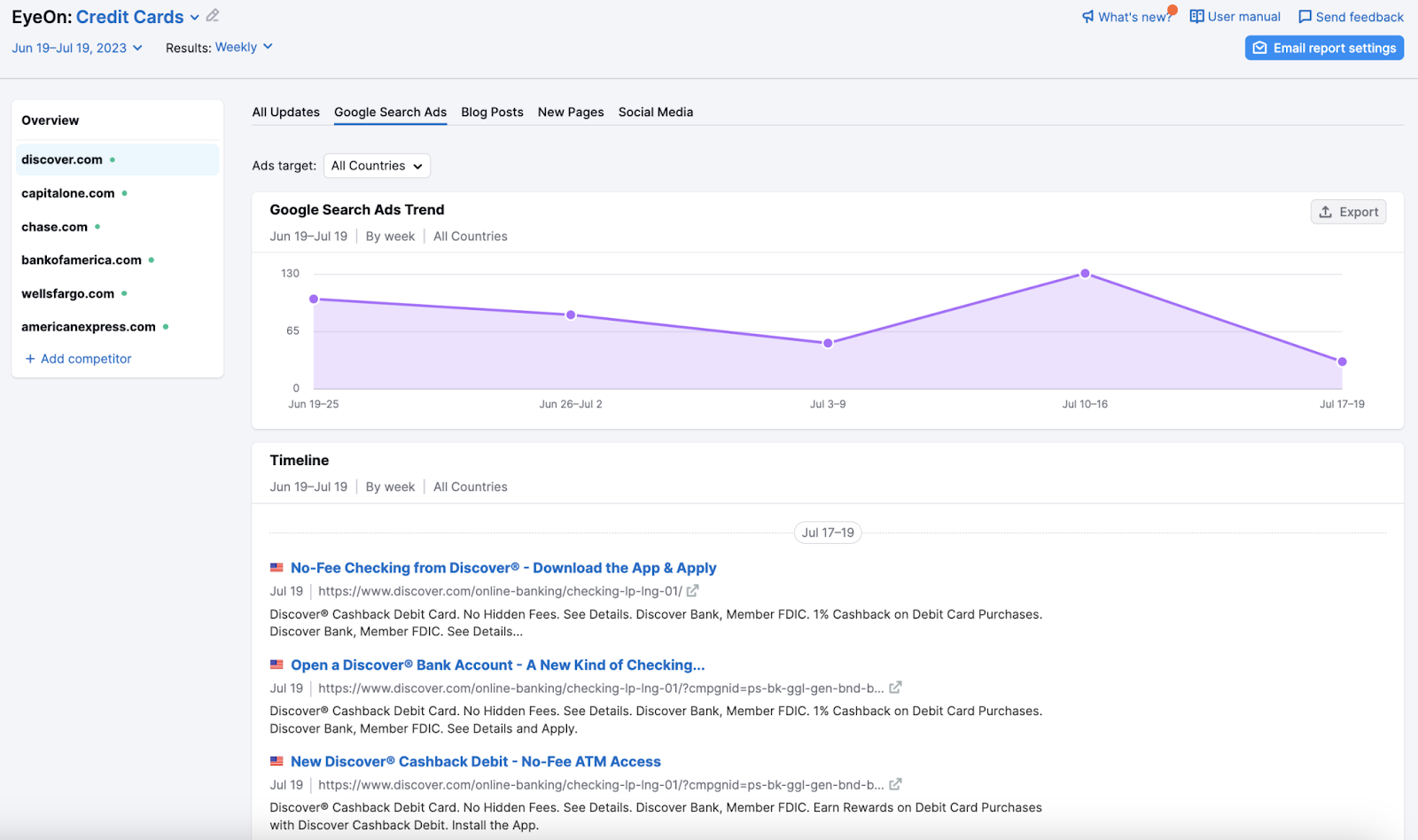

Digital marketing competitor analysis is an ongoing process, and staying on top of competitor activity is crucial. Semrush’s EyeOn tool makes it easy to track competitors 24/7 so you never miss a beat.

Here, we entered our top credit card competitors along with their social media. We also turned on email alerts to get updates straight to our inbox. Here’s a look at the overview report which shows activity and trends for:

- All activity updates

- New web pages

- New blog posts

- Google Search Ads

- Social Media Posts

- Social Engagement

You can also gather activity data for a single domain by making a selection in the sidebar. For example, here’s a look at discover.com’s Google Search Ad activity.

By tracking competitor activity data, you can identify new promos, shifts in competitor targeting, and new promos that will allow you to respond quickly to threats and take advantage of opportunities.

Analyze Competitor Activity Data with Your Own Goals and Strategy in Mind

Now that you’ve walked through the key steps of a recurring competitor analysis, you need to make sense of your findings.

- Assess how competing businesses’ actions and your marketing ideas correlate with your initial strategy.

You may discover that a long-term campaign you started six months ago doesn’t correspond to the current market trends and needs. Well, it’s definitely better to find out now than in another six months.

- Filter out any ideas that are not in line with your company’s offering, positioning, ultimate goals, or strategy.

No matter what brilliant insights you have found by looking at your competition, if they don’t align with your brand idea or roadmap, it’s better to push them to the back burner. And this is when the next point becomes crucial.

- Communicate competitive intelligence to other departments.

Competitor analysis can reveal insights that are not yet actionable for the marketing team but will be appreciated in the sales department, for example. Needless to say, any intelligence is invaluable for executives.

Think of those colleagues who could benefit from your findings and don’t hesitate to share your competitor analysis report with them.

- Encourage and initiate changes in your marketing plans and strategy (if needed)

If you’re halfway through your marketing campaign and, compared to rivals, it isn’t producing great results, don’t be afraid of making tweaks or even rethinking the entire strategy. At the end of the day, this is why you do competitor research: to discover greener fields and move to them as quickly as possible.